Spread trading for beginners

How to Spread Trade

Spread trading is arguably the most straightforward method of speculating on financial markets. With spread trading you have the opportunity to back your own judgement on markets such as stock indices, shares, commodities and Forex, all from a single account.

What is a ‘spread’?

The word 'spread' in Spread Trading refers to the difference between our selling price and our buying price. The price you can sell at is always lower than the price at which you can buy, and the smaller this spread is, the cheaper it is for you to trade.

If you think the price of a market is going to go up, you "buy" (this is also known as ‘going long’) at the higher price on our spread. If you think the price of a market is going down, you "sell" (or ‘go short’), at the lower end of our spread.

Your stake is the amount you want to trade for each point movement in your chosen market. So if you decide to buy £10 per point of, say, the UK 100 stock index, and the market rises sufficiently so you’re able to sell and close your trade 5 points higher, you would make a profit of £50 (5 points x £10 stake).

How do I start trading spreads?

Trade Nation offers fixed spreads on all our spread trading markets. You can have complete confidence that our spreads won’t rise when markets are volatile.

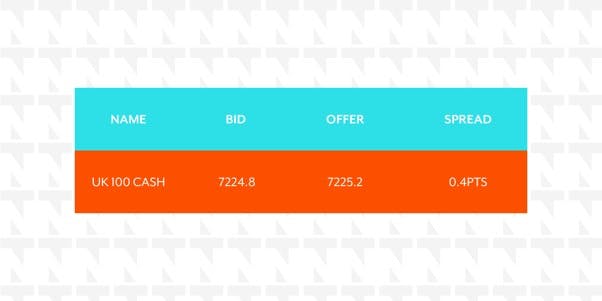

The image above is an example of one our most popular markets, the UK100 Cash (you will see this in the news as the FTSE100). This can easily be found on our trading platform and can be traded in a stake as low as 10p per point move of the market.

As you can see, the 'BID' is the price you would trade at if you thought the market was going to fall from this level. This is lower than the 'OFFER' price which is what you would trade at if you expected the market to rise from here. The difference between the two prices is the spread, or cost of dealing, which is fixed at 0.4 points during normal trading hours*.

Let's say you buy £5 per point at a price of 7425.2.

An hour later the market has risen by 10 points and we are now quoting a price of 7434.8 to sell and 7435.2 to buy. You decide to close your trade and bank your profit. To do this you need to trade in the opposite direction. As your original trade was a ‘buy’ you now ‘sell’ an equal stake of £5 per point to close your trade.

You sell at 7434.8, closing your original trade. So how much money have you made?

This is calculated by taking the difference between the price of the second closing trade and the price of the first opening trade. In our example this is:

7434.8

7425.2

= 9.6 difference

We then multiply this number by the original stake which was £5 a point. This gives you a profit of 9.6 x £5 = £48

But what about if the market had moved against you? Let’s say the UK 100 Cash had fallen by 10 points: we would have been quoting a price of 7414.8 to sell and 7415.2 to buy. Had you decided to close your trade at this time you would have sold £5 (remember that you need to place a trade in the opposite direction of the original) at the bid price of 7414.8

This results in a difference in price of:

7414.8

7425.2

= 10.4 difference

The difference is then, again, multiplied by the stake of £5, resulting in a loss of £52.

In both examples the Trade Nation charge, a fixed spread of 0.4 points, doesn't change. This is why it is important to trade at a competitive fixed spread allowing you to reduce your transaction costs and maximise your returns.

*Trade Nation has fixed spreads on all its spread trades for set time bands. Our spread on the UK 100 Cash index is just 0.4 between the hours of 07:00 and 21:00 GMT and 5 points between 21:00 and 07:00. See our trading platform for full specifications on all the markets we offer.