Fixed spreads:

The key to transparent trading

Scroll Down

Fixed spreads make trading fairer

We’re committed to offering you a better way to trade financial markets. Transparency is key, and that’s why all our markets have fixed spreads.

Maximise profits with our fixed spreads

We invite you to compare our spreads with those of our competitors when, for instance, a central bank updates its interest rate or there’s an unexpected geopolitical event.

Competitors may also increase their charges when there’s a rush to trade, such as when markets open, and in the minutes leading up to the close.

However, our spreads stay low and fixed no matter what and can reduce trading costs in the long run. For regular traders, these small savings add up very quickly.

Fixed vs. variable: what’s the difference?

No matter what you trade, there is always a spread – the difference between the selling price and the buying price.

Fixed spreads

- Are just that, fixed. These stay exactly the same within specific trading sessions, offering total transparency so you can be certain of your trading costs.

Variable spreads

- Could change at any time. Many companies offer low variable spreads which can look appealing at first glance. Sure, there will be times during the day when the spread is as low as advertised. But wait until economic data is published or something unexpected happens and these ‘low spreads’ will widen dramatically, often when you most wish to trade. This can make a considerable difference to your profitability as a trader.

Why does this matter?

A winning trade can quickly become a losing one when you’re having to give so much more money to the broker.

Imagine having to pay 5 times as much to close a trade as you did to open it. Why put up with this uncertainty when you can know in advance what your spreads will be at all times?

That’s why we only offer low fixed spreads on our trading platform.

EXAMPLE OF A SINGLE TRADE

How fixed spreads can boost your profits

The charges that you pay to trade with us are fixed during each trading session and we proudly advertise these on our website and trading platform. The market could be moving 100 points every 5 seconds, but what we charge you doesn’t change. Take the example below.

Chris is an active day-trader who uses any winnings he makes to go on exotic family holidays. He uses a well-known broker who advertises spreads on the Wall Street 30 index as ‘From 1’.

EXAMPLE OVER A YEAR

How fixed spreads save money in the long run

The above shows how Chris could have profited from a single trade. To

see how fixed spreads could save money in the long run we’ve compared his trading with his colleague Sarah.

Sarah is saving up for a new house with her partner and trades with Trade Nation. Here, the spread on the Wall Street 30 index is ‘Fixed at 1’ in the main trading session. In contrast, Chris uses a well-known broker who advertises variable spreads on the Wall Street 30 index ‘From 1’.

Chris & a variable spread

Chris trades this index 2 times a day for

£5 per point.

The spread is advertised as ‘From 1’ but it’s usually

3 points when Chris trades.

He decides to work out how much he pays in spread each month:

2 trades a day means 10 trades per week, so 40 trades each month

So, 40 trades × £5 per point × a variable spread of 3 points

= £600

This means Chris pays £7,200 per year.

Sarah & a fixed spread

Sarah also trades this index 2 times a day for

£5 per point.

Sarah can be sure any spread she trades on will remain at

1 pointat all times.

She calculates her spread costs per month in the same way:

2 trades a day means 10 trades per week, so 40 trades each month

So, 40 trades × £5 per point × a fixed spread of 1 point

= £200

This means

Sarah pays £2,400 per year.

Chris & a variable spread

Sarah & a fixed spread

Chris trades this index 2 times a day for

£5 per point.

The spread is advertised as ‘From 1’ but it’s usually

3 points when Chris trades.

Sarah also trades this index 2 times a day for

£5 per point.

Sarah can be sure any spread she trades on will remain at

1 pointat all times.

He decides to work out how much he pays in spread each month:

2 trades a day means 10 trades per week, so 40 trades each month

So, 40 trades × £5 per point × a variable spread of 3 points

= £600

This means Chris pays £7,200 per year.

She calculates her spread costs per month in the same way:

2 trades a day means 10 trades per week, so 40 trades each month

So, 40 trades × £5 per point × a fixed spread of 1 point

= £200

This means

Sarah pays £2,400 per year.

In summary:

Over the course of a year,

Sarah saves herself £4,800thanks to fixed spreads.

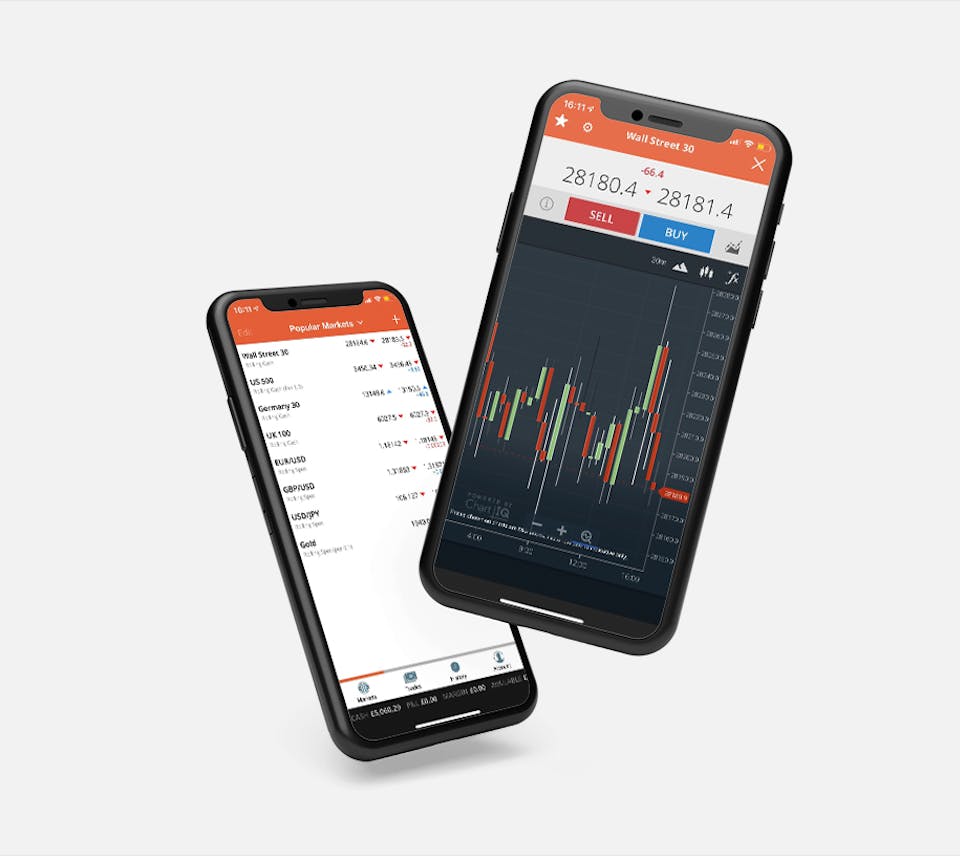

Get to know our platform with a free practice account

Our online trading platform is very easy to use, so come and see for yourself by signing up for a risk-free practice account free of charge.

This means you can get to know the platform without spending a penny, which is the perfect way for you to build confidence if you’re a beginner. Explore, learn and make mistakes without any commitment.