How to spread trade

Spread trading is exciting and fast moving. You make your own decisions and back your own judgement about how prices will move. There are loads of financial markets to choose from including Forex, stock indices, shares and commodities. Not only that, but it’s as easy to sell a market if you think it’s going to fall in price, as buy one if you think it’s going to rise. This means that there are opportunities to make money whatever the market conditions, and trading costs are low.

The spread

In spread trading, you never actually own the stock index, barrel of oil or whatever else you’re trading. Instead, you’re simply speculating on whether the price will rise or fall. The ‘spread’ is the difference between the selling price and the buying price. The smaller this is, the more cost effective your trading. Our spreads are amongst the lowest in the industry which means that your trading costs are low. Not only that, but our spreads don’t increase when markets get volatile which is what happens with many other providers.

So, how do I start spread trading?

Firstly, choose your market. We have a huge range of financial markets, including Forex, stock indices, shares and commodities for you to consider. Picking a market and trading opportunity that’s right for you is important so make sure you do a little research and find something that suits your trading style. For instance, is there something you’re particularly interested in, such as a certain industry or the price of oil? You may have some experience or knowledge here that could be helpful.

Opening a position

Take a look at the above image. It’s an example of one of our most popular markets, the UK100 stock index. This can be traded in a stake (the amount you want to trade for each point movement in your chosen market) as low as 10p per point. This means that for every point that the UK100 goes up, or down, in price, you will make, or lose, 10p. You’ll see two prices. The lower price is called the ‘BID’ and is what you’d sell at if you thought the market was going to fall from this level. The higher price is called the ‘OFFER’ and this is what you would buy at if you expected the market to rise from here. The difference between the two prices is known as the spread which is our charge and the cost of trading this market. As you can see, this is a fixed spread of 0.4 points.

Closing the trade

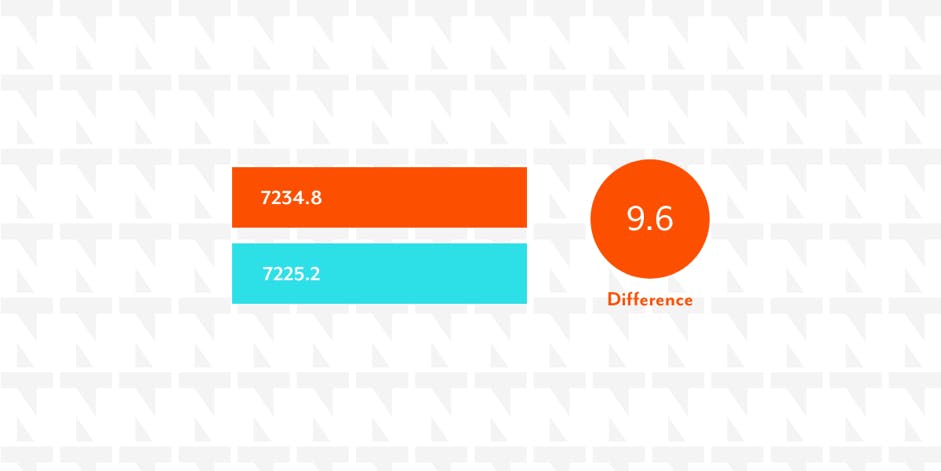

Let’s say you’ve done your research and you feel that the UK100 is likely to rise in price in the near future. You decide to buy £5 per point at a price of 7225.2. An hour later the market has risen by 10 points and we’re now quoting a price of 7234.8 to sell and 7235.2 to buy. You decide that it’s time to bank your profit and close your trade. To do this you need to place a trade in the opposite direction. As your original trade was a purchase of £5 per point, you now need to sell £5 per point to close the position.

Your profit

So, you sell £5 per point at 7234.8 which closes your original trade. How much money have you made? We calculate this by taking the difference between the price where you closed your trade and where you opened it. Looking back at our above example, we can see that the difference is 9.6. Multiply this by £5 (the stake ) and you have a profit of £48.

There are many reasons why people are attracted to spread trading. It’s exciting and fast moving, you can trade a large range of markets from a single account, you can make your own trading decisions and the entry costs are low. Most markets are open 24-hours a day for 5 days a week, so you can trade whenever it suits you. Remember though, it’s high risk and there’s always the possibility of losing money. So never spread trade with money that you can’t afford to lose.